Biography

Mauritz received a PhD in quantum physics from Stellenbosch University under the supervision of Michael Kastner. His doctoral research consisted of the study of long-range interactions in quantum lattice systems. The main emphasis was placed on deriving mathematical models from the principles of quantum mechanics in order to understand and predict the behaviour of trapped ion quantum simulators.

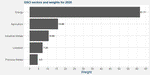

During 2015, after completing his Ph.D., Mauritz started at Polar Star in the capacity of a quantitative analyst. His primary roles consisted of data gathering, cleaning, warehousing and modeling. He spent 2016 in the Cayman office where he focused on developing Polar Star’s in house data visualisation and trade filtering software. This software creates a bird’s eye view of the commodity landscape from Polar Star’s point of view and it is used to find suppressed and stretched calendar and inter-commodity spreads.

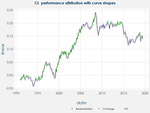

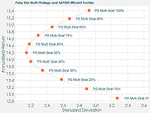

Mauritz returned to Cape Town during 2017, where he spent the majority of his time investigating quantitative strategies in the commodities space. Over time some of these strategies were given small allocations within the flagship fund to test them out with real money. These strategies have subsequently been spun out into an independent quantitative commodity fund that launched during January 2019.

Currently, Mauritz is the portfolio manager for the Polar Star Quantitative Commodity Fund and heads up Polar Star’s Quantitative research efforts.

Interests

- Global Commodities Markets

- Artificial Intelligence

- Reinforcement Learning

- Data Science

Education

-

PhD in Quantum Physics, 2015

Stellenbosch University

-

MSc in Mathematical Physics, 2012

University of Pretoria

-

BSc in Mathematical Physics, 2009

University of Pretoria