Debunking Long-Only Commodity Inveting

Debunking Long-Only Commodity Inveting

Abstract

A question we get asked often is if we have a long-only commodities product or if we can give investors access to long only commodities exposure. In this talk, we show why this is, in general, not a good idea. We do this by studying the Bloomberg Commodities index which is one of the long-only commodity benchmarks. We introduce the concepts of backwardation and contango and show how the curve structure affects the profits of a long-only portfolio.

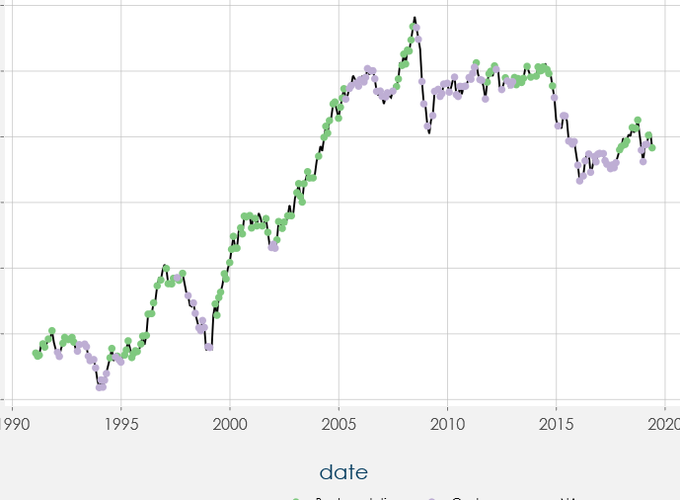

We create a proxy index roughly based on the Bloomberg Commodity Index with weightings equal to the average of all available weight data and follow the rolling methodology outlined by the index. We show the effects of backwardation and contango of the performance of the long-only index and create a hybrid index that can take both long and short exposure in the underlying commodities.

We show how a trend following strategy, that only includes the BCOM commodities and expiries, outperforms all the previous index constructions. We compare the performance attributions of the different commodities during periods of backwardation and contango.

Finally we show how the suite of Polar Star Funds outperforms all of these benchmarks.