Introduction

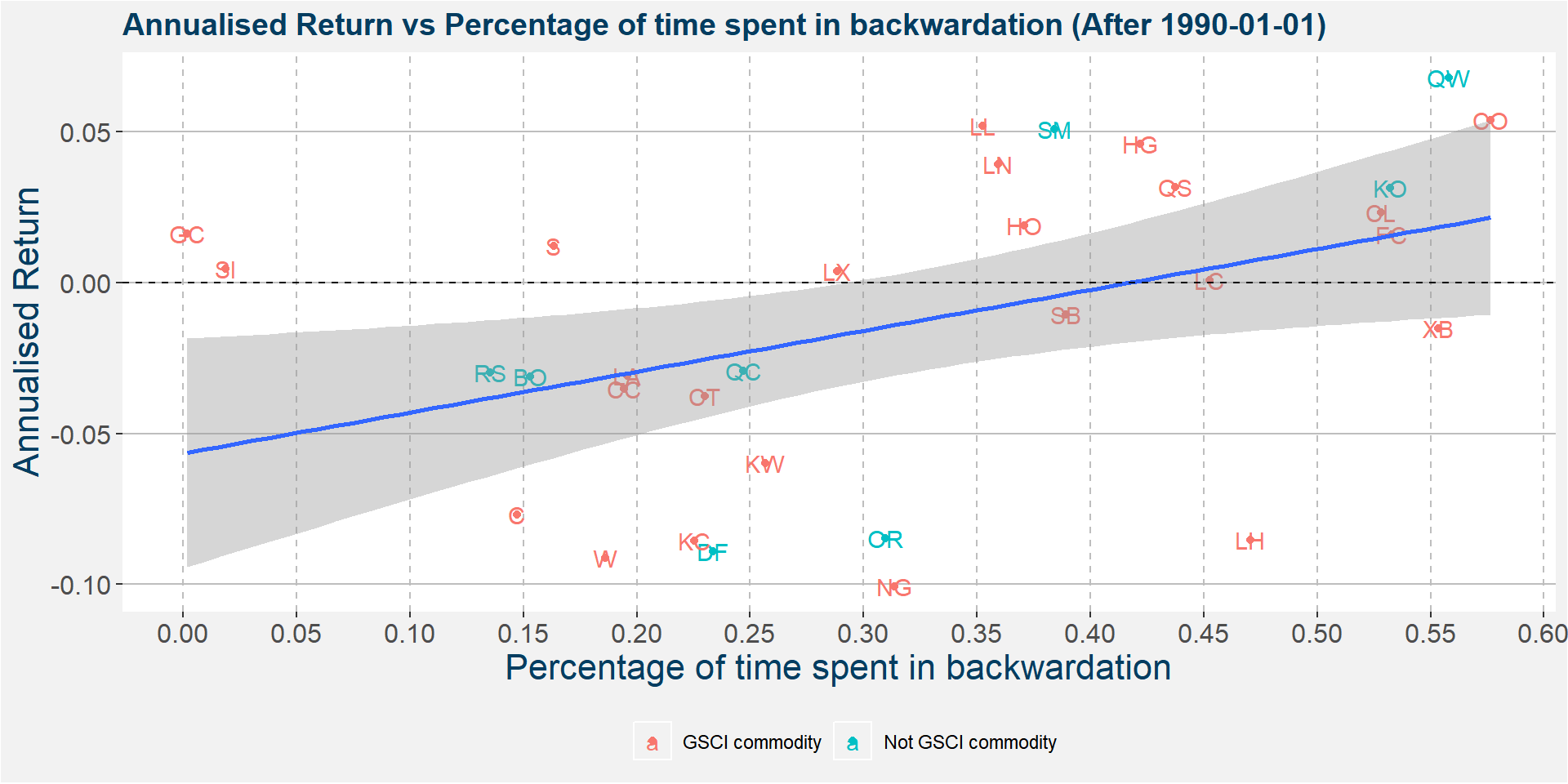

In a previous post we have tried to debunk long only commodity investing. The main arguments why it does not work over long time frames is because of the curve structure associated with commodities that have to be stored in warehouses or silos. Below we show the annualised return of long only positions consisting entirely of the commodity shown as a function of percentage of time spent in backwardation. We distinguish between those commodities that are part of the GSCI and those that are not. We superimpose a linear fit to all the data points. Notice the positive slope associated with the fit. This shows that an increased time spent in backwardation leads to greater annualised returns. Below we only consider data from 1 Jan 1990 onward. Returns are calculated on roll adjusted price series and transaction costs are not included.

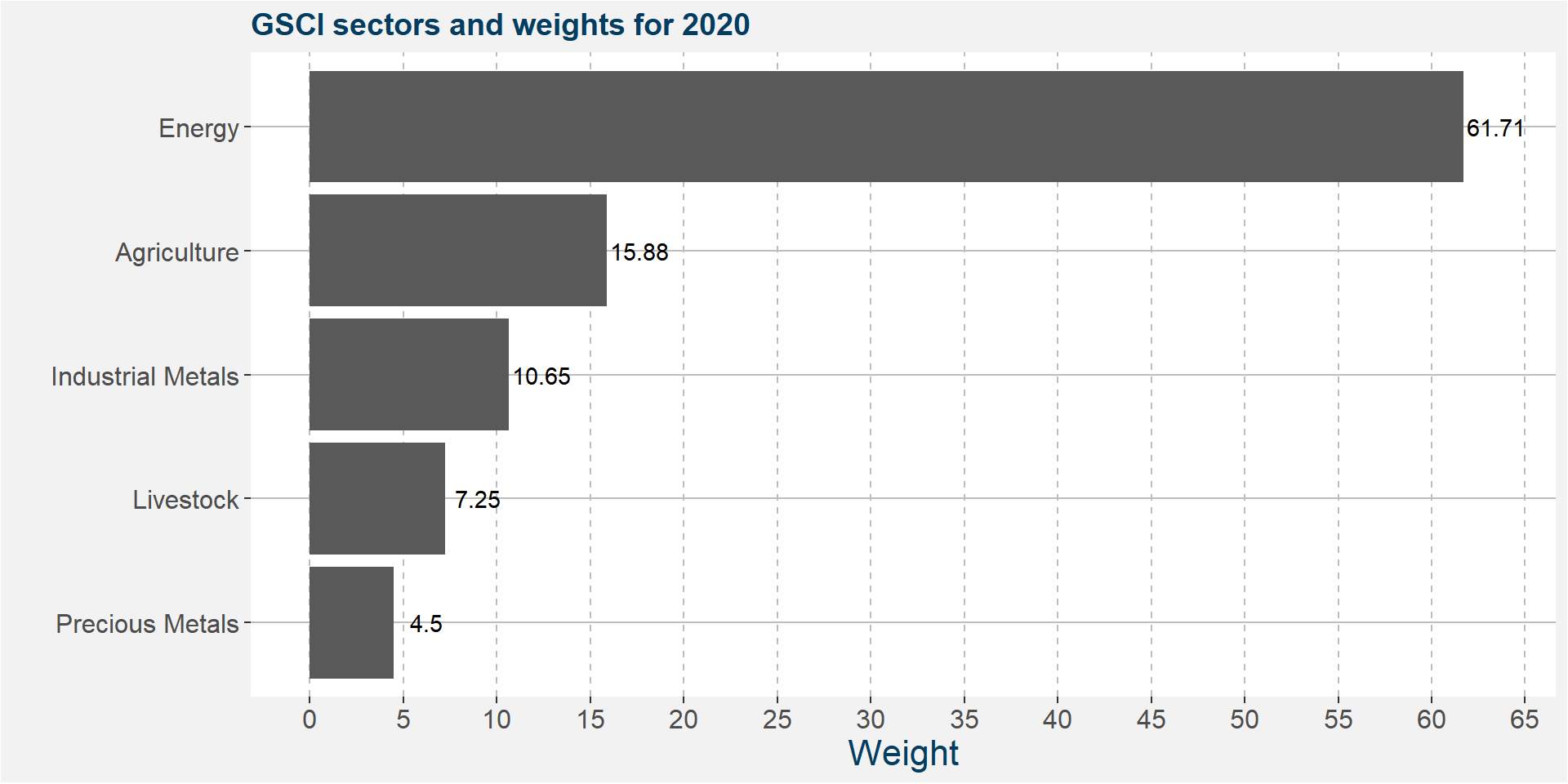

The GSCI is a production weighted index designed to reflect the relative significance of each of the constituent commodities to the world economy. These types of commodity indices are notoriously highly skewed in favour of energies. The weightings for the different sectors for the calendar year 2020 are shown in the plot below. The plot above and below shows us that the index will only perform well when the commodities in the energy sector are in sustained periods of backwardation.

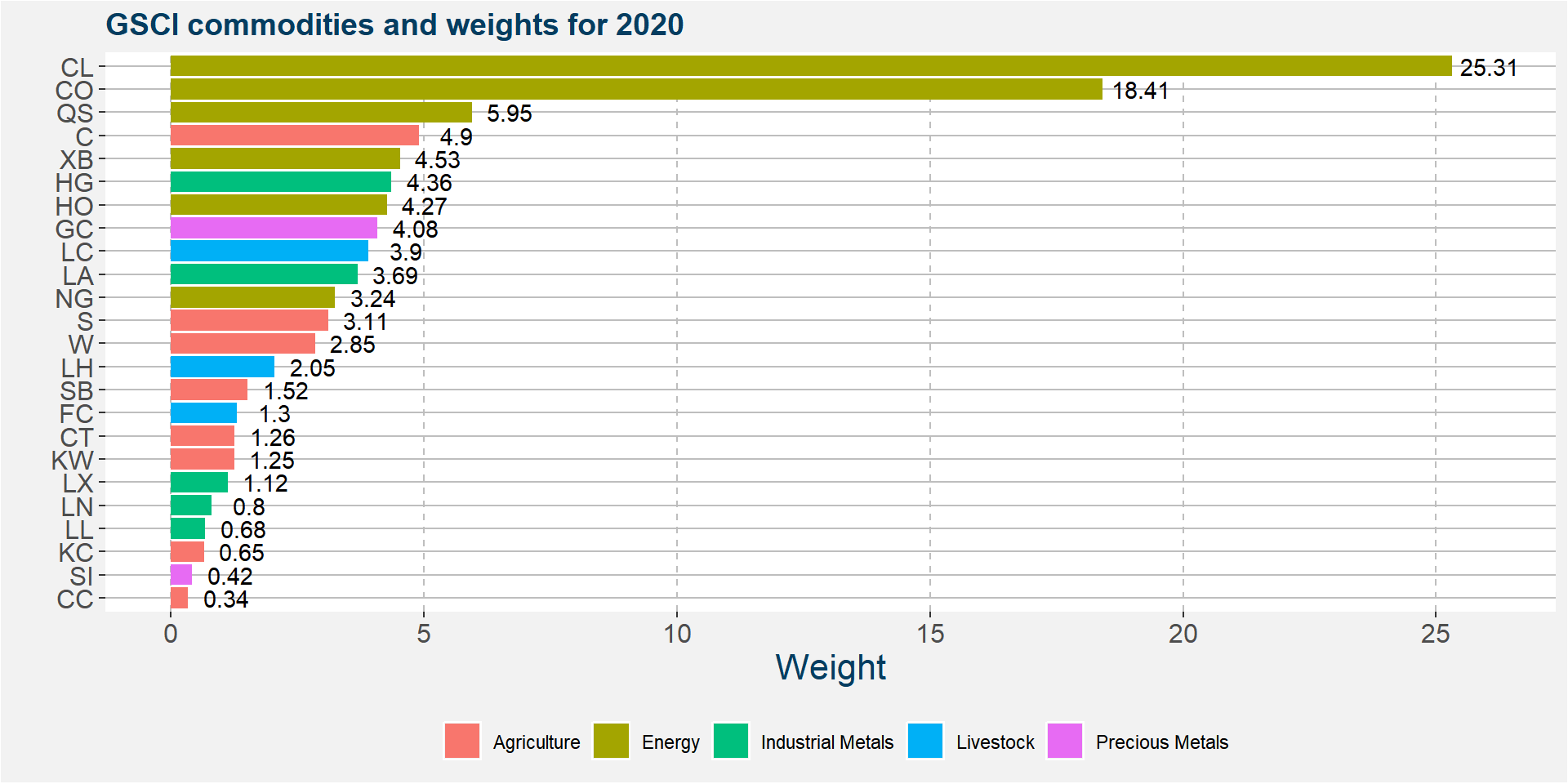

The plot below delves a little deeper to give the weights of the individual components making up the GSCI. Note the WTI and Brent Crude Oil make up the lion’s share of the portfolio allocation.

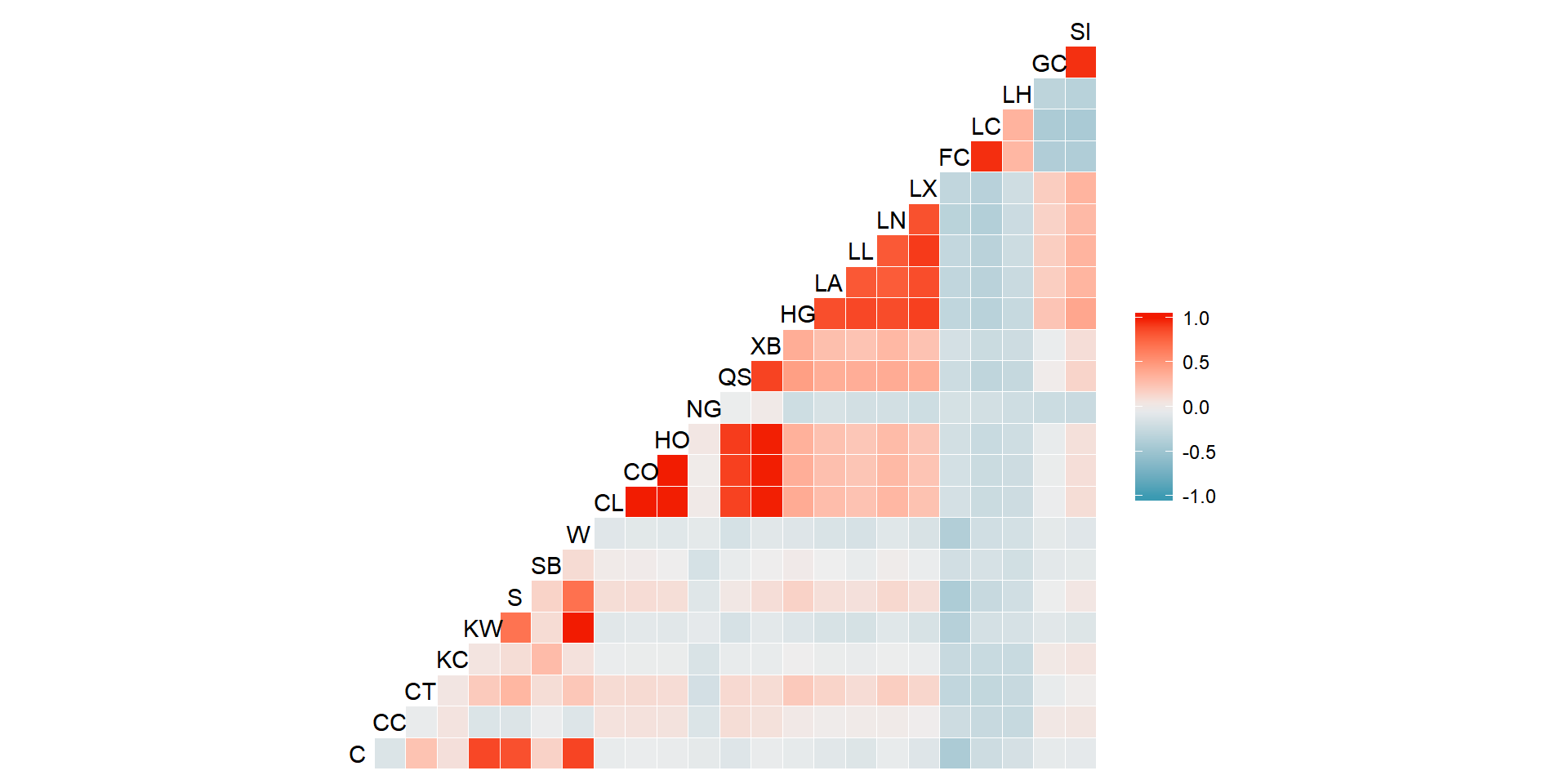

The plot below shows the correlations between the returns of the commodities making up the GSCI. The more red (blue) the colour the greater the positive (negative) correlation. From the image below it is clear that the energy complex is highly correlated, except for NG. Also interesting to note is that the livestock sector has low to negative correlation with most commodities. Similar to the energies we also see that the industrial metals are highly correlated. These two sectors actually only make two bets because of the high degree of correlation.

Reconstructing GSCI

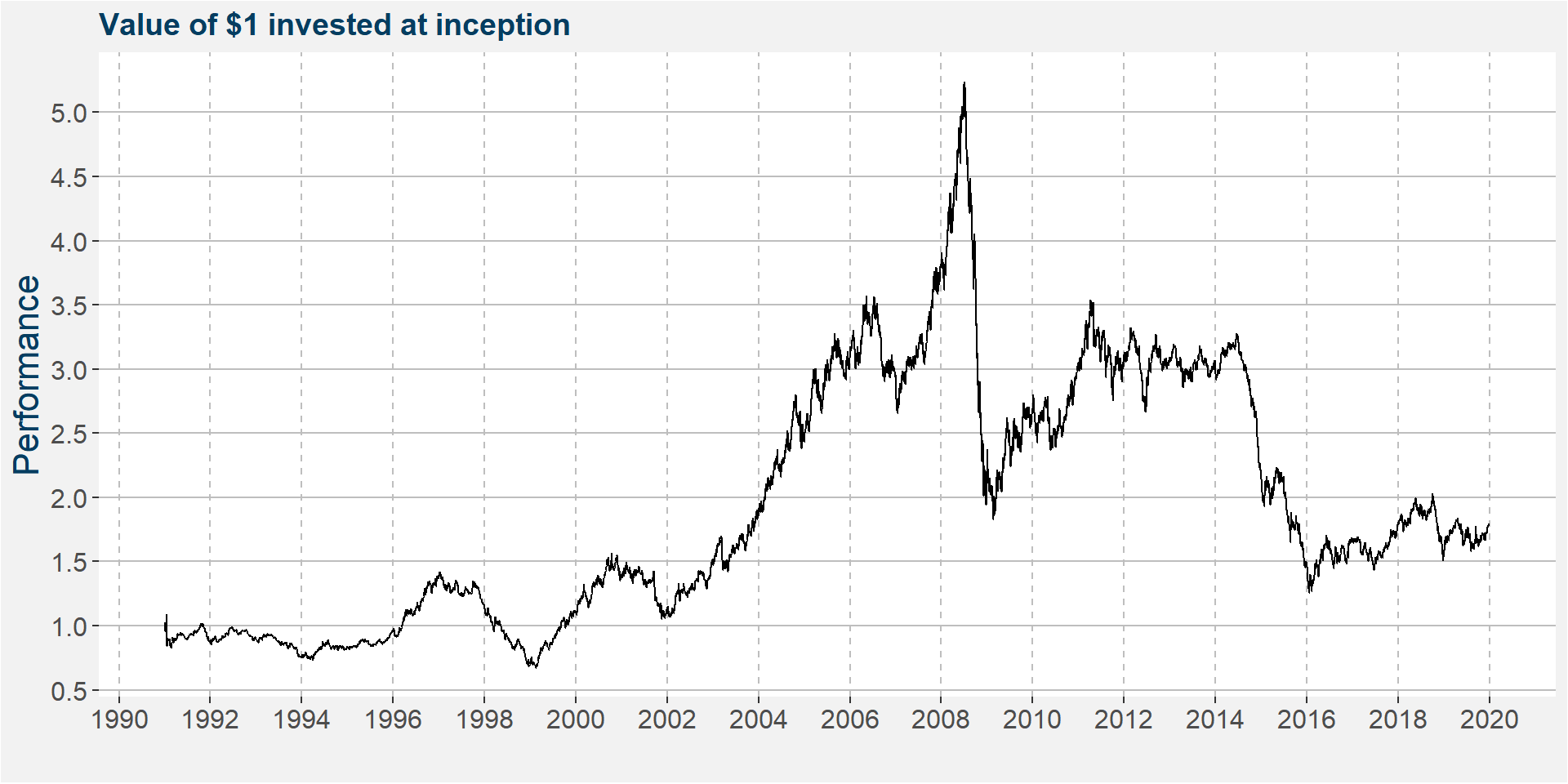

In this section we reconstruct the GSCI by taking the current weights as a proxy for the historical weights. The value of $1 invested in the spread in represented in the plot below.

The tables below show the risk and return statistics of the GSCI.

| Return Statistics | |

|---|---|

| Last Month | 0.17 |

| Year To Date | 0.17 |

| 3 Month ROR | 6.92 |

| 12 Month ROR | 6.47 |

| 36 Month ROR | 7.50 |

| Total Return | 99.72 |

| Compound ROR | 2.41 |

| Best Month | 20.12 |

| Win % | 55.75 |

| Risk Statistics | |

|---|---|

| Ann.Std.Deviation | 18.42 |

| Max. Drawdown | 72.98 |

| Month to Recover | 140.00 |

| Worst Month | -26.04 |

| Losing % | 44.25 |

| Avg Losing Month | -4.26 |

| Loss Deviation | 3.68 |

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.13 |

| Sortino Ratio | 0.19 |

| Omega Ratio | 0.18 |

| Skewness | -0.36 |

| Kurtosis | 1.74 |

| Best | Worst | Average | Median | Last | Winning (%) | Avg. Pos. Period | Avg. Neg. Period | # Of Periods | |

|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 20.12 | -26.04 | 0.34 | 0.65 | 0.17 | 55.75 | 3.99 | -4.26 | 348 |

| 3 Month | 24.44 | -43.34 | 1.14 | 1.86 | 6.92 | 56.07 | 8.08 | -7.71 | 346 |

| 6 Month | 43.92 | -56.88 | 2.40 | 2.84 | 3.80 | 58.60 | 12.29 | -11.59 | 343 |

| 1 Year | 79.12 | -52.60 | 5.15 | 2.89 | 6.47 | 57.86 | 21.06 | -16.70 | 337 |

| 2 Year | 107.06 | -55.86 | 10.85 | 5.95 | -3.27 | 56.31 | 35.60 | -21.03 | 325 |

| 3 Year | 145.77 | -55.96 | 15.76 | 8.75 | 7.50 | 57.51 | 44.53 | -23.16 | 313 |

| 5 Year | 218.54 | -57.82 | 30.65 | 8.53 | -11.20 | 59.17 | 70.18 | -26.64 | 289 |

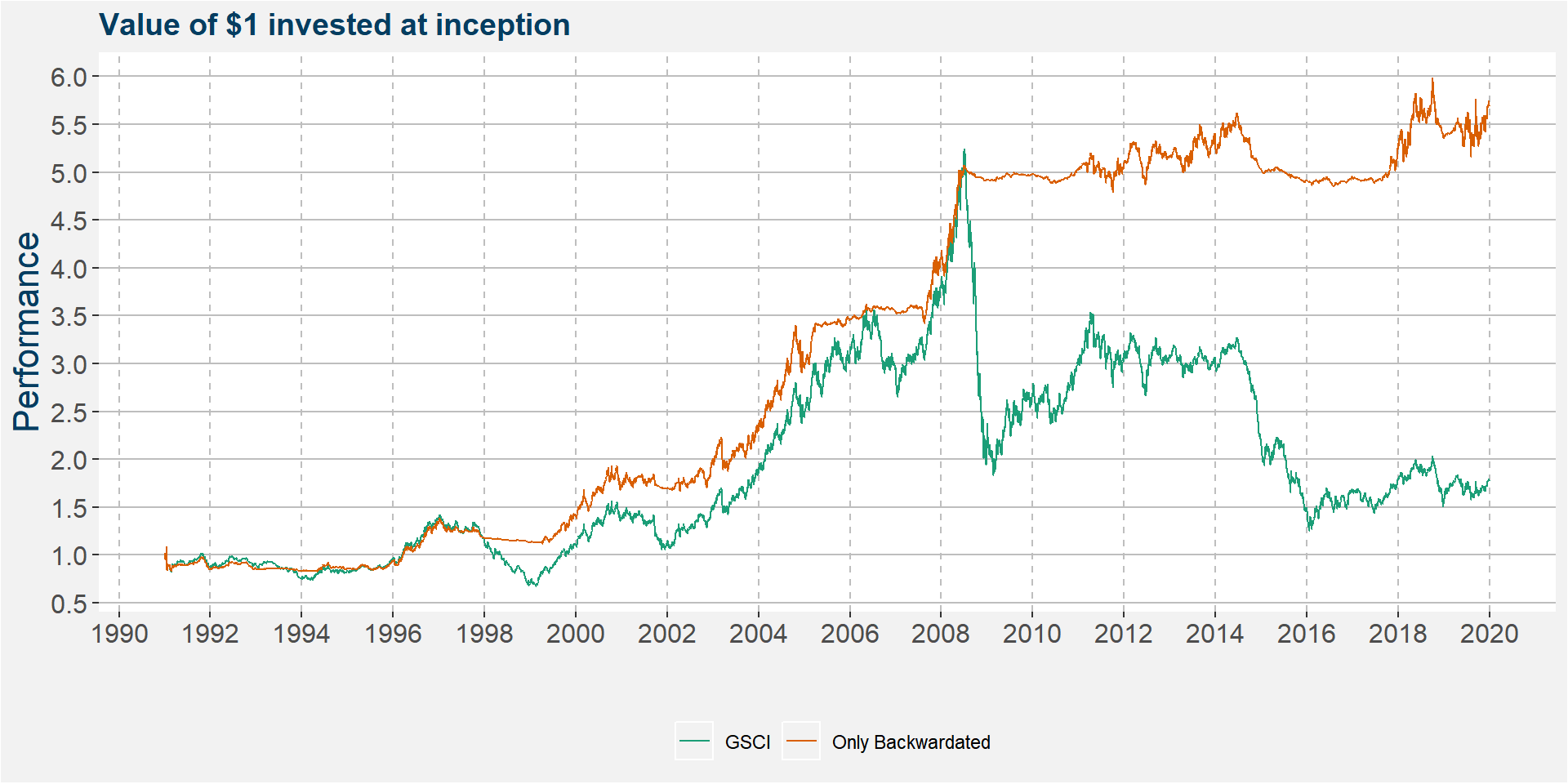

Backwardation Mask

In this section we add a backwardation mask. Here we only take up the long position when the commodity is in backwardation. Notice that a large portion of the massive drawdown during 2009 was avoided.

The performance statistics of the Backwardation Mask strategy is significantly better than it original GSCI.

| Return Statistics | |

|---|---|

| Last Month | 0.09 |

| Year To Date | 0.09 |

| 3 Month ROR | 5.70 |

| 12 Month ROR | 5.63 |

| 36 Month ROR | 15.76 |

| Total Return | 537.43 |

| Compound ROR | 6.60 |

| Best Month | 10.03 |

| Win % | 56.32 |

| Risk Statistics | |

|---|---|

| Ann.Std.Deviation | 9.45 |

| Max. Drawdown | 15.87 |

| Month to Recover | 35.00 |

| Worst Month | -9.19 |

| Losing % | 43.68 |

| Avg Losing Month | -1.47 |

| Loss Deviation | 1.75 |

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.70 |

| Sortino Ratio | 1.09 |

| Omega Ratio | 0.89 |

| Skewness | 0.39 |

| Kurtosis | 1.99 |

| Best | Worst | Average | Median | Last | Winning (%) | Avg. Pos. Period | Avg. Neg. Period | # Of Periods | |

|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 10.03 | -9.19 | 0.57 | 0.17 | 0.09 | 56.32 | 2.15 | -1.47 | 348 |

| 3 Month | 21.52 | -9.91 | 1.73 | 0.48 | 5.70 | 58.09 | 4.50 | -2.10 | 346 |

| 6 Month | 25.19 | -9.73 | 3.50 | 0.99 | 2.84 | 60.35 | 7.53 | -2.63 | 343 |

| 1 Year | 54.59 | -12.58 | 7.40 | 2.39 | 5.63 | 66.77 | 12.93 | -3.73 | 337 |

| 2 Year | 82.57 | -15.60 | 16.15 | 8.23 | 5.93 | 76.00 | 22.83 | -5.02 | 325 |

| 3 Year | 97.21 | -11.70 | 25.56 | 21.94 | 15.76 | 82.75 | 32.00 | -5.33 | 313 |

| 5 Year | 156.07 | -6.92 | 50.41 | 41.97 | 14.08 | 89.62 | 56.58 | -2.91 | 289 |

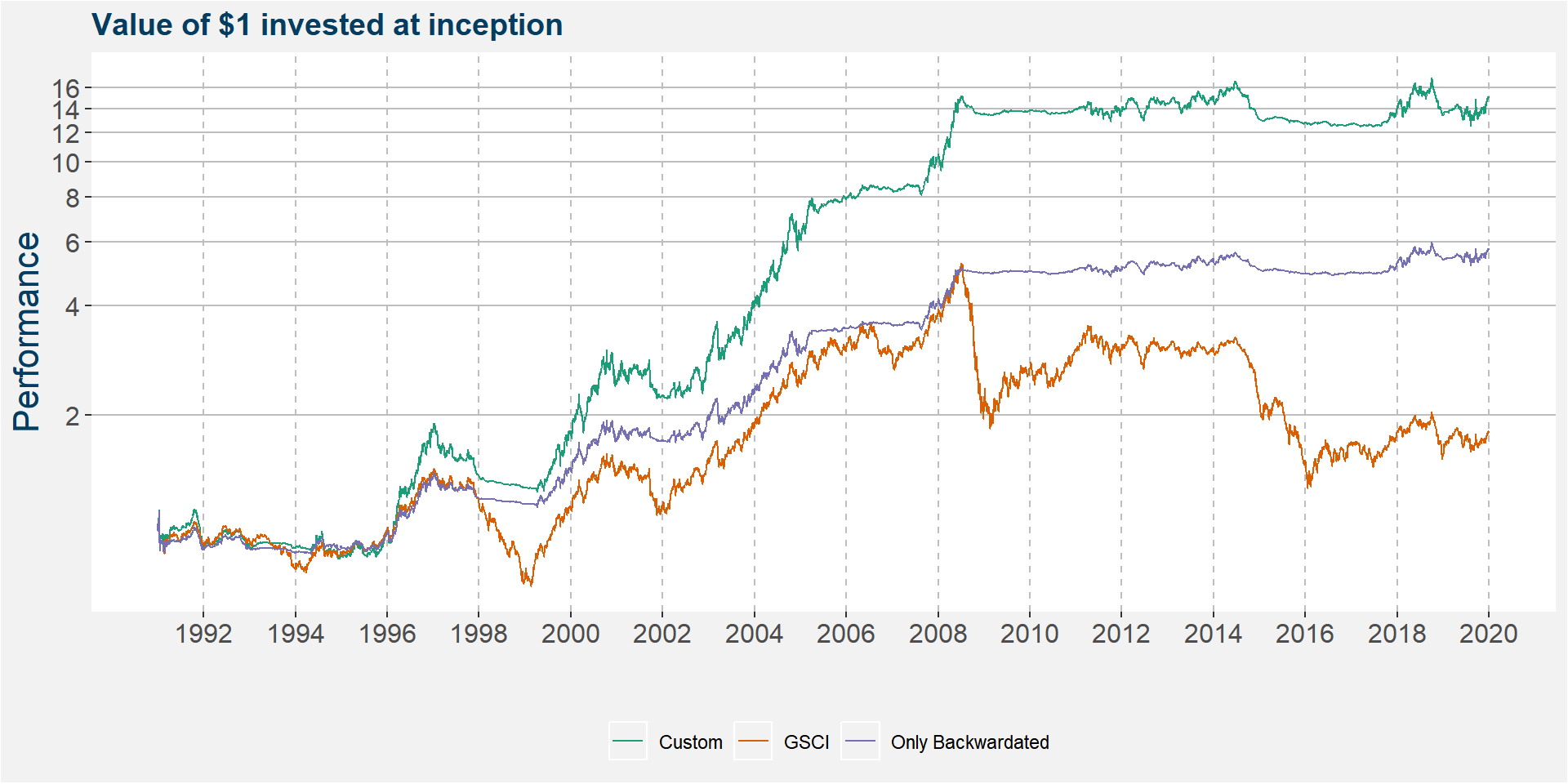

Custom

In this section we add diversification by

- having five weekly roll schedule. This amount to haveing five different portfolios, the center portfolio used the same rolling methodology as the GSCI. The plus 1 and plus 2 portfolios roll one and two week after the GSCI respectivley. Similarly the minus 1 and minus 2 portfolios roll one and two weeks prior to the GSCI.

- adding another part of the futures curve. The GSCI only trades in the front part of the futures curve of each commodity. Here we simply add another the following contract too. We only add the next contract as some of the commodities might have slight liquidity issues with much further dated contracts.

- keeping the GSCI weights.

To better compare the results over a long time frame we show the performance in logarithmic scale.

The performance statistics of the Backwardation Mask strategy is significantly better than it original GSCI.

| Return Statistics | |

|---|---|

| Last Month | 0.26 |

| Year To Date | 0.26 |

| 3 Month ROR | 12.89 |

| 12 Month ROR | 10.33 |

| 36 Month ROR | 16.88 |

| Total Return | 1929.89 |

| Compound ROR | 10.94 |

| Best Month | 19.27 |

| Win % | 56.03 |

| Risk Statistics | |

|---|---|

| Ann.Std.Deviation | 18.09 |

| Max. Drawdown | 32.45 |

| Month to Recover | 68.00 |

| Worst Month | -15.67 |

| Losing % | 43.97 |

| Avg Losing Month | -2.98 |

| Loss Deviation | 3.28 |

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.60 |

| Sortino Ratio | 0.96 |

| Omega Ratio | 0.76 |

| Skewness | 0.40 |

| Kurtosis | 1.64 |

| Best | Worst | Average | Median | Last | Winning (%) | Avg. Pos. Period | Avg. Neg. Period | # Of Periods | |

|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 19.27 | -15.67 | 1.00 | 0.33 | 0.26 | 56.03 | 4.13 | -2.98 | 348 |

| 3 Month | 48.37 | -26.13 | 3.09 | 0.88 | 12.89 | 56.07 | 9.01 | -4.46 | 346 |

| 6 Month | 65.35 | -28.48 | 6.33 | 1.50 | 9.25 | 58.02 | 15.41 | -6.21 | 343 |

| 1 Year | 120.02 | -27.68 | 14.07 | 2.88 | 10.33 | 56.08 | 31.29 | -7.93 | 337 |

| 2 Year | 215.27 | -31.95 | 32.69 | 10.35 | -1.45 | 67.08 | 53.86 | -10.45 | 325 |

| 3 Year | 284.27 | -32.45 | 53.51 | 36.73 | 16.88 | 76.04 | 74.40 | -12.78 | 313 |

| 5 Year | 539.74 | -27.44 | 119.23 | 77.31 | 13.39 | 79.24 | 154.21 | -14.32 | 289 |

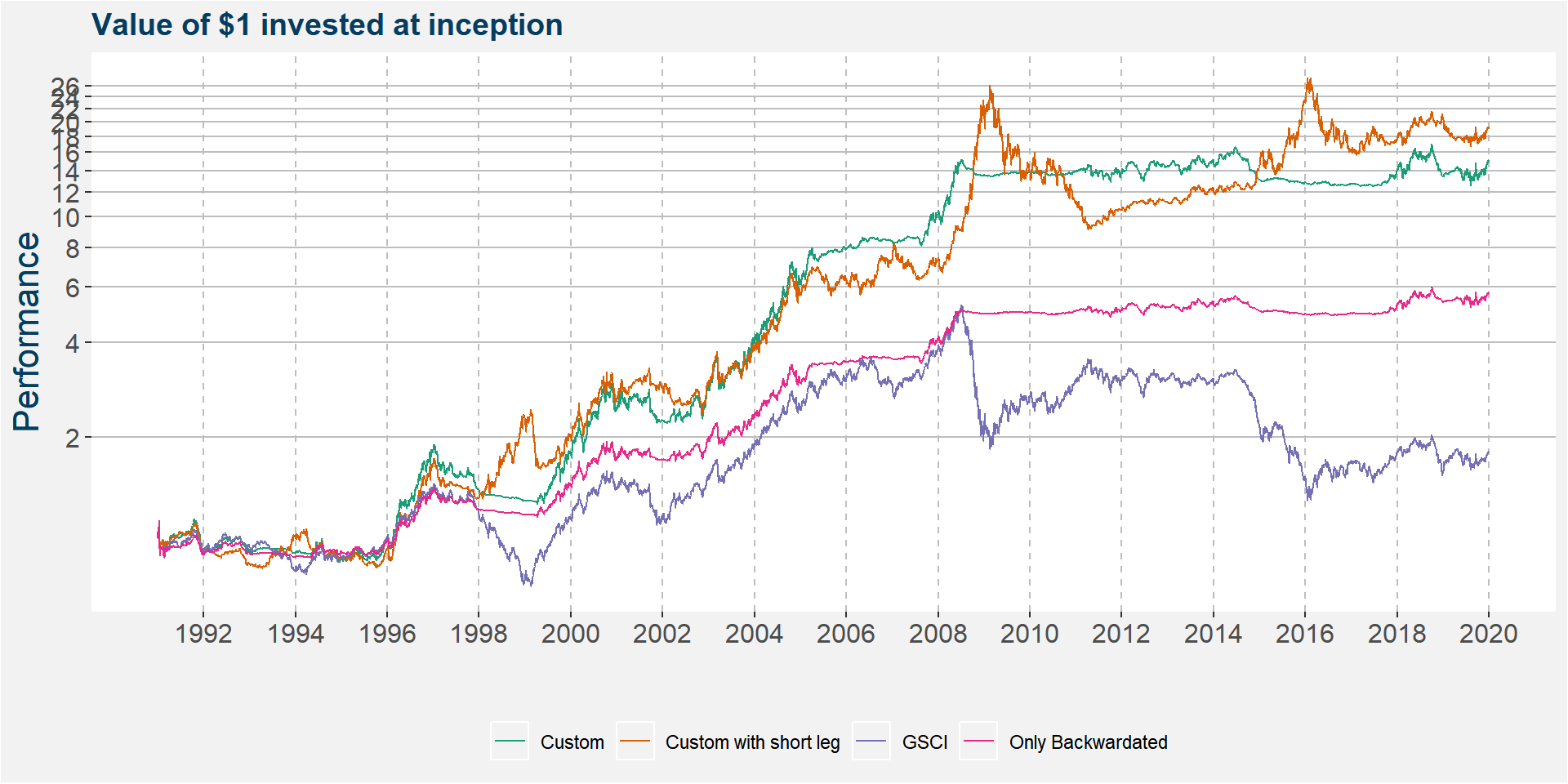

Adding the short positions

Below we extend the custom portfolio by add the short legs. This amounts to adding short positions to those commodities that were in contango during the rebalance period.

The performance statistics of the Backwardation Mask strategy is significantly better than it original GSCI.

| Return Statistics | |

|---|---|

| Last Month | 0.20 |

| Year To Date | 0.20 |

| 3 Month ROR | 10.65 |

| 12 Month ROR | 0.82 |

| 36 Month ROR | 17.39 |

| Total Return | 1963.91 |

| Compound ROR | 11.00 |

| Best Month | 41.26 |

| Win % | 56.03 |

| Risk Statistics | |

|---|---|

| Ann.Std.Deviation | 24.50 |

| Max. Drawdown | 68.97 |

| Month to Recover | 132.00 |

| Worst Month | -32.51 |

| Losing % | 43.97 |

| Avg Losing Month | -4.49 |

| Loss Deviation | 4.96 |

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.45 |

| Sortino Ratio | 0.64 |

| Omega Ratio | 0.57 |

| Skewness | 0.03 |

| Kurtosis | 4.82 |

| Best | Worst | Average | Median | Last | Winning (%) | Avg. Pos. Period | Avg. Neg. Period | # Of Periods | |

|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 41.26 | -32.51 | 1.12 | 0.71 | 0.20 | 56.03 | 5.53 | -4.49 | 348 |

| 3 Month | 89.17 | -38.39 | 3.62 | 2.13 | 10.65 | 58.96 | 11.61 | -7.86 | 346 |

| 6 Month | 152.12 | -41.03 | 7.67 | 3.43 | 7.17 | 58.31 | 20.84 | -10.74 | 343 |

| 1 Year | 288.69 | -47.91 | 16.59 | 8.80 | 0.82 | 61.42 | 35.66 | -13.77 | 337 |

| 2 Year | 284.92 | -65.84 | 34.21 | 21.23 | 2.79 | 78.77 | 49.11 | -21.06 | 325 |

| 3 Year | 344.97 | -64.09 | 54.35 | 44.46 | 17.39 | 80.19 | 72.81 | -20.41 | 313 |

| 5 Year | 647.09 | -56.94 | 109.36 | 83.14 | 17.76 | 92.73 | 120.09 | -27.57 | 289 |

Remarks

- The long term long-only performance of a commodity depends highly on it’s curve structure

- When the curve is in backwardation for sustained periods a higher return is more likely

- We can create a better risk adjusted index than the GSCI by

- Adding more commodities

- Adding different parts of the futures curves

- Adding different roll periods