A Better Long Only Commodity Product

A Better Long Only Commodity Product

Abstract

We show some examples of how to create a better long only commodity product and add some shameless plugs at the end.

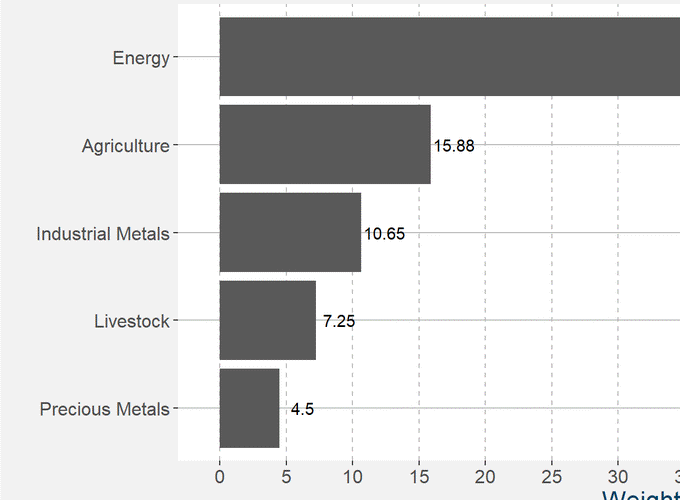

We create a proxy index roughly based on the GSCI Index with weightings equal to the latest available weight data and follow the rolling methodology outlined by the index. We show the effects of backwardation and contango of the performance of the long-only index and create a hybrid index that only takes long positions during backwardation.

We show how a trend following strategy, that only includes the GSCI commodities and expiries, outperforms all the previous index constructions. We compare the performance attributions of the different commodities during periods of backwardation and contango.

Finally we show how the suite of Polar Star Funds outperforms all of these benchmarks.